Spotlight on Market Leadership in the Web3 x AI Supercycle

- Decasonic

- Jan 14, 2025

- 4 min read

Updated: Sep 25, 2025

Mapping the Market Leaders of This Supercycle -- Rizza Torres, Marketing Manager at Decasonic

We Are at the Early Stages of the Web3 x AI Supercycle

The convergence of Web3 and AI marks the dawn of a new digital economy, where decentralized economic ownership meets intelligent systems. This supercycle will be transformative, driving a paradigm shift in how industries operate, users interact, and economies—both digital and physical—grow. Together, Web3 and AI are reimagining global markets, catalyzing the next big wave of innovation and opportunity.

Why Is This the Biggest Shift Yet?

2024 Capital Flows Signal Confidence

Venture funding for AI and blockchain is surging at historic levels. In 2024, investments in AI crossed $200 billion, while Web3 funding exceeded $24 billion, a testament to the market’s belief in the potential of this convergence. Capital is now flowing into sectors like gaming, DeFi, social, AI agents, real-world assets (RWAs), and consumer applications, enabling a fertile ecosystem for innovation.

A $10 Trillion Addressable Market

By 2030, the combined market potential for Web3 and AI is estimated to exceed $10 trillion, spanning applications across finance, entertainment, social platforms, and infrastructure. The integration of AI into blockchain-based systems is creating entirely new industries, such as decentralized AI marketplaces and tokenized economies.

Accelerating User Adoption

With over 500 million active blockchain wallets and AI tools becoming household staples, adoption is growing exponentially. AI enhances accessibility, while Web3 enables trust and ownership. Together, they’re driving users into decentralized ecosystems at an unprecedented pace.

Web3 and AI Solve Problems of Complexity and Transparency

Historically, blockchain adoption has been slowed by complexity, while AI innovation has struggled with transparency. The convergence of these technologies solves both problems. AI simplifies blockchain interaction through natural language interfaces, while blockchain provides transparency and ownership for AI systems.

Why Now?

The timing of this supercycle is today:

Bull Market Tailwinds: Weekly sector market capitalization across GameFi, social, consumer crypto, DeFi, and RWAs is growing, signaling robust market momentum and market rotation into Web3 and AI.

Regulatory Clarity: The rise of pro-crypto policies, such as Bitcoin ETFs and tokenized asset frameworks, is unlocking institutional adoption. Additionally, the U.S. is solidifying its leadership in blockchain and AI by appointing a dedicated crypto and AI czar, ensuring focused oversight and strategic guidance. This reflects a continued embrace of U.S.-led capabilities in AI, further reinforcing America’s position as a global innovator in AI and decentralized technologies.

Technology Alignment: Blockchain’s scalability and AI’s computational power are coming together to address longstanding industry challenges, from financial inclusion to data ownership.

At Decasonic, we are product-first investors, focusing on adoption-driven innovation across Web3 sectors. We are deploying enhancement capital into high-growth opportunities to lead this transformative wave. We aim to partner with outlier founders who aspire to build market category leaders.

The Role of Market Maps

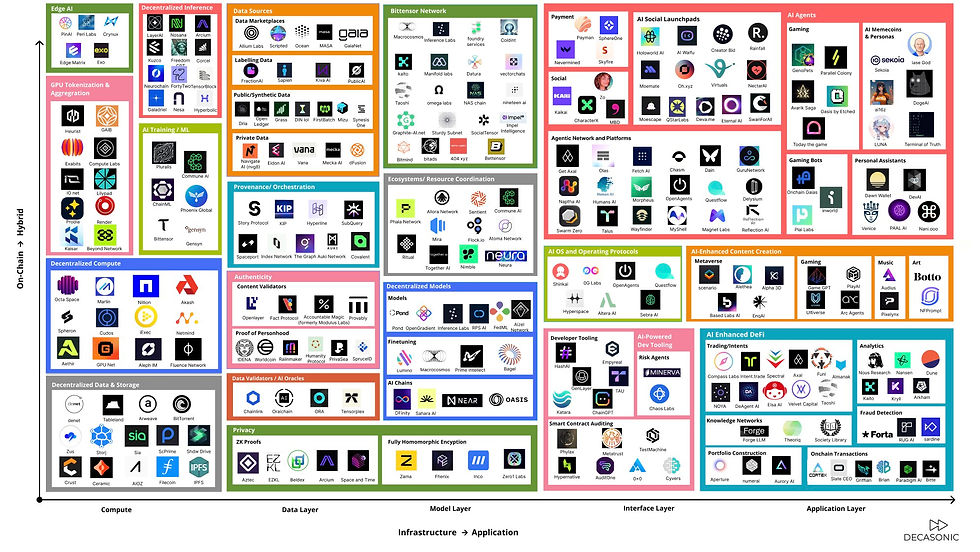

To demystify the vast opportunities in the Web3 x AI supercycle, this spotlight blog post introduces four market maps that illustrate how Web3 and AI are creating new opportunities and provide a strategic lens into the players, trends, and innovations:

1. AI and GameFi Market Map

Gaming is the tip of the spear for product innovations. The competitive dynamics in the gaming industry drive game developers to be early adoptors of disruptive technologies. The convergence of AI and blockchain is transforming GameFi into a more personalized and decentralized ecosystem.

AI Personalization: AI agents enhance gameplay by creating adaptive, real-time experiences

Tokenized Economies: Blockchain enables in-game asset ownership, allowing players to trade and monetize freely

2. AI and DeFi Market Map

AI is solving one of DeFi’s biggest challenges—complexity—while also optimizing its financial systems for wealth creation.

Streamlined Interfaces: AI agents simplify DeFi interactions by enabling natural language commands for portfolio management and yield optimization

Risk Mitigation: AI analytics provide real-time monitoring and risk reduction for liquidity pools and lending platforms

3. Consumer Web3 and AI Market Map

AI and Web3 are transforming consumer applications, making blockchain interactions seamless and intuitive.

Enhanced User Interfaces: AI-powered wallets detect scams, offer recommendations, and abstract blockchain complexity

Tokenized Social Platforms: SocialFi is leveraging AI to create dynamic, 24/7 engagement with tokenized communities and personalized content

4. AI and RWA Market Map

Real-world assets (RWAs) are being tokenized at scale, and AI is enabling precision and efficiency in valuation and trading.

Institutional Adoption: Tokenized treasuries and real estate are gaining traction among institutional investors

AI Valuation Models: AI tools enhance accuracy in asset valuation, creating trust in decentralized marketplaces

The Web3 x AI Opportunity

The Web3 x AI Supercycle is big, not just in size but in scope. It’s creating new markets, addressing systemic inefficiencies, and unlocking exponential growth opportunities. From the transformation of gaming and finance to the tokenization of real-world assets, the convergence of AI and Web3 is shaping the future of digital economies.

Decasonic is uniquely positioned to lead in this era of innovation. The market maps introduced in this spotlight are not just blueprints for understanding the landscape—they’re a reflection of our commitment to driving adoption, enabling innovation, and shaping the future of Web3 and AI.

This is why it’s big—and why we are here to lead the charge. If you're building in the Web3 x AI space, we want to hear from you. Reach out to our team.

Dive more into Decasonic's Web3 x AI Market Map 2024:

The content of these blog posts is strictly for informational and educational purposes and is not intended as investment advice, or as a recommendation or solicitation to buy or sell any asset. Nothing herein should be considered legal or tax advice. You should consult your own professional advisor before making any financial decision. Decasonic makes no warranties regarding the accuracy, completeness, or reliability of the content in these blog posts. The opinions expressed are those of the authors and do not necessarily reflect the views of Decasonic. Decasonic disclaims liability for any errors or omissions in these blog posts and for any actions taken based on the information provided.

Comments